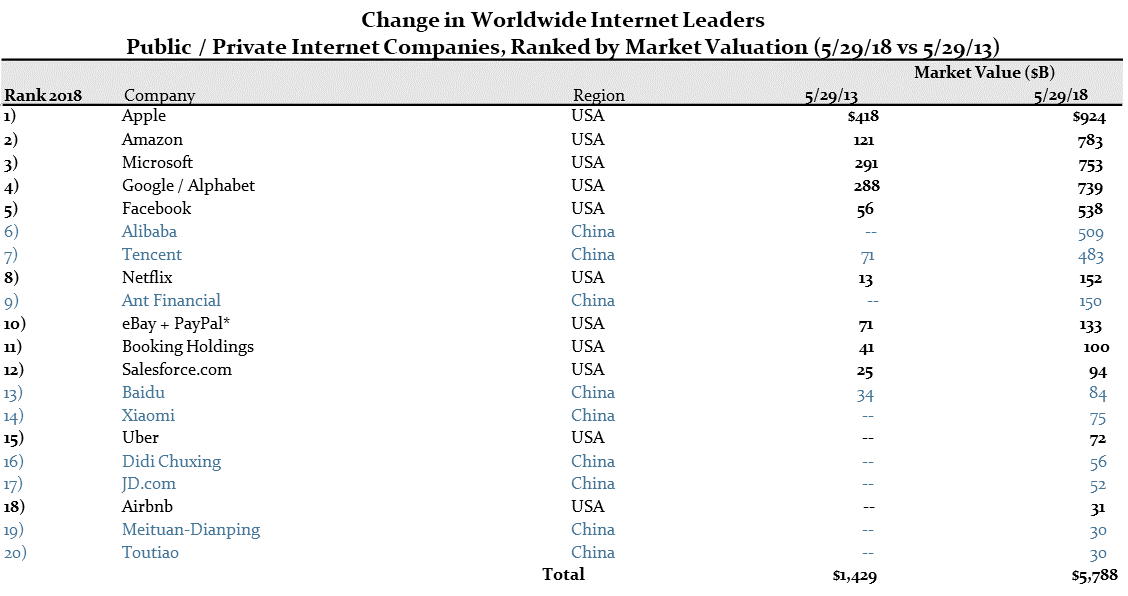

China is a fertile market for finding the types of entrepreneurial companies that Dalton seeks to partner with. Using the internet sector as an example, China went from having two global leading companies (of the top twenty global internet companies by market value) to nine in just five years.

Source: Bloomberg

Investors in China tend to concentrate into just a few of the largest companies in China, creating overvaluation and risk. As a result of this crowding, there are frequent mis-pricings and buying opportunities in lesser known names. We currently find great long-term opportunities across several themes:

- Rising incomes and premiumization (food, funeral services, logistics, education, wealth management)

- Leisure and lifestyle (travel, hotels and restaurants; gaming and digital entertainment)

- Digitization (cloud computing, data centers)

- Health and wellness (pharmaceuticals, elder care)

- RMB depreciation (exporters)

- Smart manufacturing and automation (hardware and components)

Trade Wars, Deleveraging and Regulations – A Perfect Storm

Over the past year, the “trade war” between the US and China has depressed investment sentiment in China. Alongside this, President Xi Jinping’s deleveraging campaign has slowed Chinese growth. Hardest hit by this campaign have been privately-owned enterprises, which have struggled to access credit (unlike their state-owned competitors). This has come alongside a slowdown in state and local government fixed asset investment. In addition to this deleveraging, there has been a series of confusing, inconsistent regulations from the Chinese government, resulting from the merging and restructuring of ministries. For example, a planned social security tax increase added to this negative sentiment. Again, hardest hit with this have been privately-owned enterprises, particularly in the education, online games and property sectors.

Valuations Indicate a Reasonable Entry Point

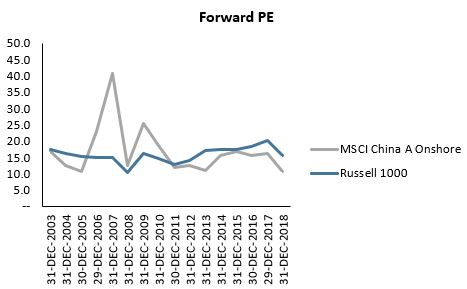

As a result of these developments, the MSCI China (offshore Chinese shares) index fell over 30% from its recent peak in January 2018 to the end of the year. At year-end 2018, the index traded at just 12x forward price/earnings (PE), with the MSCI China A Onshore (A shares) trading even lower at 11x forward PE. For comparison, the Russell 1000 traded at 16x forward PE. In the past, valuation discrepancies of this magnitude (2005, 2013) have tended to result in a period of major outperformance for the Chinese market.

Source: FactSet

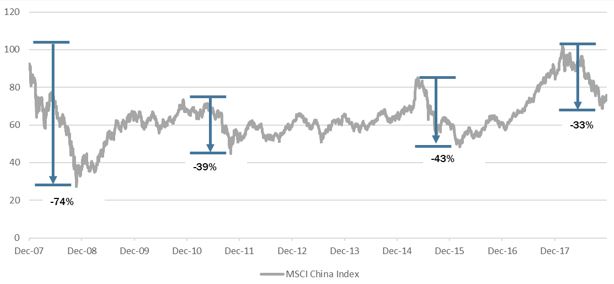

Prior major selloffs of the Chinese markets have usually lasted 6-12 months, before reversing:

- 2008: -74% over 12 months

- 2011: -39% over 6 months

- 2015: -43% over 10 months

- 2018: -33% and ongoing in its 11th month

Source: FactSet

Policy Support Has Reached a Turning Point

We believe that the current situation in China as described above represents a good opportunity to invest in select Chinese companies. Policy began to turn supportive in late 2018. The People’s Bank of China has begun to moderately ease monetary policy, including loosening the Reserve Requirement Ratio (the amount of reserves that banks are required to hold). It also announced tax cuts to both corporates and individuals. Finally, and perhaps most importantly, President Xi spoke in support of privately run enterprises: lower tax burdens, easier financing for private businesses, and a fair business environment for private enterprises. We believe that further decreasing regulations and market reforms, along with a de-escalation of the trade war, will further improve sentiment.

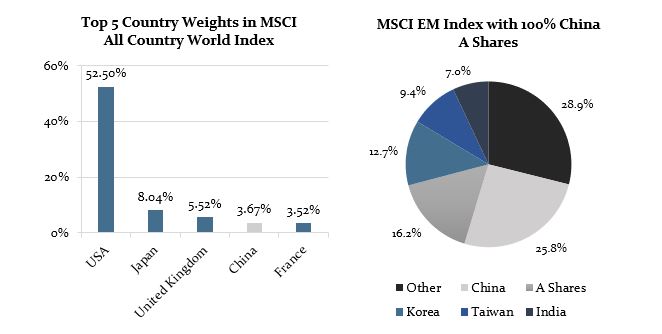

A-share Inclusion in Indices Adds Multi-Year Tailwind

China is the world’s second largest economy, with approximately 14% of global nominal GDP in 2018. However, its stock market currently represents less than 4% of the standard global index (MSCI ACWI). We believe the increasing ease of access of the Chinese A Share market should help to address this imbalance, as benchmark providers such as MSCI increase the inclusion of A Shares in their market standard indices. Notably, if A shares were given a full weight in the benchmark emerging markets index (MSCI EM), the overall China weight would rise to 42% from 31% today.

Source: FactSet

No representation or warranty can be given with respect to the accuracy or completeness of the information, or with respect to the terms of any future offer of transactions conforming to the terms hereof. Certain assumptions may have been made in the analysis which resulted in any information and returns/results detailed herein. No representation is made that any results/returns indicated will be achieved or that all assumptions in achieving these returns have been considered or stated. Additional information is available on request. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on market conditions. Unless otherwise indicated, figures presented are preliminary, unaudited, subject to change and do not constitute Dalton’s standard books and records.

Any estimates, projections or predictions (including in tabular form) given in this communication are intended to be forward-looking statements. Although Dalton believes that the expectations in such forward-looking statements are reasonable, it can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this communication. Dalton expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in its expectations or any change in circumstances upon which such statement is based.