Dalton Investments LLC (“Dalton” or “we”) utilizes a value investment approach that seeks to invest in companies with sound, sustainable businesses, operated by managements whose interests are aligned with shareholders. Client portfolios are built one security at a time; each security being selected on its own merits, through rigorous bottom-up fundamental analysis that starts with a checklist of questions, including those specific to Environmental, Social, and Governance (“ESG”) issues. We believe that taking a holistic approach to risk assessment for each individual company, particularly for those operating in emerging markets where corporate governance is less developed and the rule of law less well-established, can, to some degree, potentially mitigate risk and, according to some studies, may help to generate superior long-term risk-adjusted returns.

Our process does not begin by excluding companies based on environmental or social risks. Rather, Dalton’s investment team includes ESG risk criteria in its evaluation of emerging market companies, focusing on governance issues (including board composition, management compensation, dividend policies, capital allocation and controversies), social issues (including labour policies, product quality and supplier code of conduct), and environmental issues (including emissions and waste policies, resource management and sustainability goals). Dalton supplements its ESG research with a dedicated, third-party ESG specialist, who provides independent analysis.

Additionally, Dalton takes an active stewardship role as an owner of its portfolio companies. Many of our portfolio companies are run by entrepreneurs whose focus on long-term success is accompanied by sound ESG policies. But where possible and when deemed beneficial to our investors, Dalton actively engages with company management seeking to promote positive change on ESG matters, particularly governance issues. We believe that dialogue with investee companies on both a private and a public basis are ways to add value to our investment process.

On the following pages, we outline a review of a range of the existing, externally-published studies on ESG investing and discuss their assistance in shaping our process.

The relationship between ESG and financial performance

In developing our understanding of the potential or possible relationship between ESG factors and financial performance, our team has reviewed numerous studies by leading academic institutions and professional entities. Please note, however, that no representations or warranties, either expressed or implied, can be made as to the data and analysis provided in the following studies. The data analysis has been prepared by the respective authors and entities, and Dalton has not verified any of the studies independently. The views and opinions expressed in the studies are those of the authors and do not necessarily reflect the opinion of Dalton.

The following studies have been instrumental in shaping our thinking in the areas of ESG:

- Corporate sustainability: first evidence on materiality1

- The impact of a corporate culture of sustainability on corporate behaviour and performance2

- Sustainable investing: establishing long-term value and performance3

- Do social responsibility screens matter when assuring mutual fund performance?4

The study Sustainable Investing: Establishing Long-Term Value and Performance published by Deutsche Bank in 2012 is of particular interest because it is a meta study that consolidated over 100 published research papers on ESG and performance and risk. The study makes the following conclusions:89% of the studies that Deutsche Bank examined show companies with high ESG ratings exhibit market-based outperformance, while 85% show accounting-based outperformance (e.g., higher return on assets, return on equity).

- 100% of the academic studies agree that companies with high ratings for corporate social responsibility and ESG factors have a lower cost of capital in terms of debt (loan and bonds) and equity.

- 89% of the studies that Deutsche Bank examined show companies with high ESG ratings exhibit market-based outperformance, while 85% show accounting-based outperformance (e.g., higher return on assets, return on equity).

Market performance

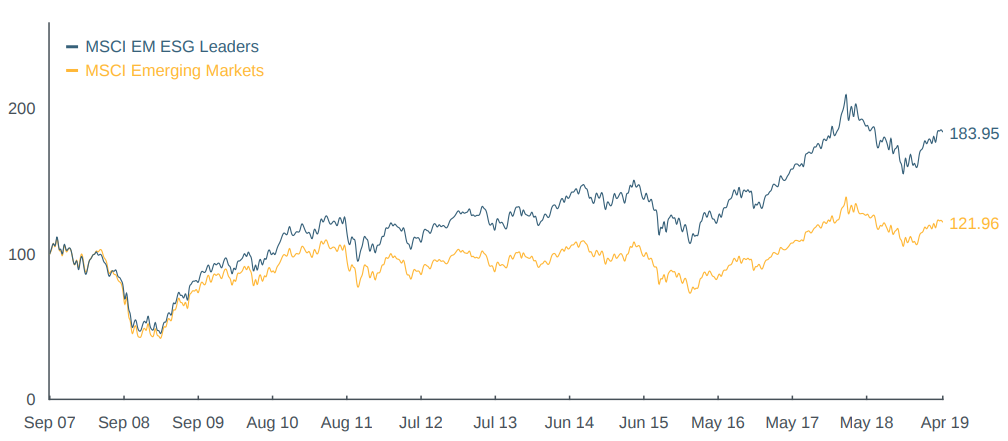

Over the past decade, in response to growing investor need for transparent information on ESG performance, MSCI Inc. developed a range of ESG indices to provide measurable performance track records of leading companies in the ESG space, using its own ESG risk assessment methodology.

One such example is the MSCI Emerging Markets ESG Leaders Index5, a capitalisation weighted index that provides exposure to companies with high ESG performance relative to their sector peers. The index was established in September 2007 by MSCI Inc.

Please note that Dalton has not independently verified or reviewed any of the constituents in, or the data used in creating, the MSCI Emerging Markets ESG Leaders Index and that Dalton makes no claims, promises or guarantees about the accuracy, completeness or adequacy of the constituents in the index or the underlying data that MSCI Inc. may have used in creating the index.

Through the end of April 2019, the MSCI Emerging Markets ESG Leaders Index had outperformed the broad MSCI Emerging Markets Total Return Index by 3.7% per annum. It achieved this outperformance with lower overall standard deviation of returns (17.0% vs 18.0% over the past ten years) and consequently had a higher Sharpe Ratio since inception (0.31 vs. 0.15).

MSCI Emerging Markets ESG Leaders Index

(Cumulative Index Performance Sep. 2007 – Apr. 2019)

| Source: MSCI |

Our approach to ESG

Based on our research on ESG, we have made the following changes to more formally include ESG factors into our investment process:

- We expanded our existing 4-Mantra approach6 to specifically include ESG items in our due diligence checklist.

- We added a dedicated, third-party ESG specialist to supplement our existing research into companies.

Our ESG process

Our ESG research specialist adopts the following approach in assessing ESG in existing and prospective investments.

- Review relevant corporate and sustainability disclosures

- Analyse available ESG data sets

- Check for controversies and legal disputes

- Check for fraud using proprietary accounting fraud analysis tool

- Prepare company ESG report for investment team

- Engage with investee companies where necessary

The ESG report also assigns a subjective ESG ranking of A, B, C or D, where A = high quality practices, B = moderate quality practices, C = low quality practices, and D = requesting a separate, additional ESG review by the analyst team.

Within the overall assessment, our ESG specialist provides a qualitative assessment of the company’s risk as it relates to ESG, accounting, litigation and any other relevant risks that may potentially impair earnings. The qualitative assessment may lead our investment team to further engage with the company, from an ESG perspective.

How our ESG process differs from third-party vendors (e.g., MSCI, Asset4, Sustainalytics)

- We do not use ESG as a screen, rather we integrate ESG into our investment approach.

- Our approach is not biased by market capitalization.

- Our approach places a greater emphasis on alignments of interest and corporate governance.

- When deemed appropriate, we directly engage with companies on ESG matters, with a focus on governance issues, and have clearly defined voting policies.

- Our process incorporates the use of accounting fraud tools to raise red flags to the overall efficacy of the financials.

______________________________________________________________

- Khan, Serafeim and Yoon (2016). “Corporate Sustainability: First Evidence on Materiality.” The Accounting Review. Vol. 91, no. 6 (November): 1697-1724.

- Eccles, Ioannou and Serafeim (2012). “The Impact of a Corporate Culture of Sustainability on Corporate Behavior and Performance.” The Harvard Business Review. Working Paper 12-035.

- Fulton, Kahn, Sharples (2012). “Sustainable Investing: Establishing Long-Term Value and Performance.” Deutsche Bank

- Briere, Peillex, Ureche-Rangau (2017). “Do Socially Responsibility Screens Matter When Assessing Mutual Fund Performance?” Financial Analysts Journal v73.n3.2.

- The MSCI Emerging Markets (EM) ESG Leaders Index, is a capitalization weighted index that provides exposure to companies with high Environmental, Social and Governance performance relative to their sector peers. MSCI EM ESG Leaders Index consists of large and mid-cap companies across 24 Emerging Markets countries. The Index is designed for investors seeking a broad, diversified sustainability benchmark with relatively low tracking error to the underlying equity market. The index is a member of the MSCI ESG Leaders Index series. Constituent selection is based on data from MSCI ESG Research. Latest factsheet is available at https://www.msci.com/documents/10199/c341baf6-e515-4015-af5e-c1d864cae53e.

- Dalton’s 4-Mantra approach is focused on investing in good businesses, where there is a significant margin of safety, where there is an alignment of interest to the owner/operator, and where there is an identifiable a strong track record of reinvesting capital.

This document is provided for informational purposes only, and does not constitute a solicitation of any shares in any investment vehicle managed by Dalton Investments LLC. Such solicitations can only be made to qualified investors by means of the private placement memorandums, which describe, among other things, the risks of making an investment. Additionally, this presentation does not constitute investment advice of any kind.

All of the information in this document relating to Dalton Investments LLC or its affiliates (collectively, “Dalton” or the “Firm”) is communicated solely by Dalton, 1601 Cloverfield Boulevard, Suite 5050 N, Santa Monica, CA 90404, regulated by the U.S. Securities and Exchange Commission (SEC). (SEC registration does not imply SEC endorsement.) No representation or warranty can be given with respect to the accuracy or completeness of the information, or with respect to the terms of any future offer of transactions conforming to the terms hereof. Certain assumptions may have been made in the analysis which resulted in any information and returns/results detailed herein. No representation is made that any results/returns indicated will be achieved or that all assumptions in achieving these returns have been considered or stated. Additional information is available on request. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on market conditions. Unless otherwise indicated, figures presented are preliminary, unaudited, subject to change and do not constitute Dalton’s standard books and records.

Please note that neither the Funds/Composites nor the Investment Manager/Investment Advisor complies with the requirements of the Alternative Investment Fund Managers Directive (“AIFMD”) of the European Union. No direct or indirect offering or placement of shares by or on behalf of the Funds/Composites or the Investment Manager may be made to or with investors in member states of the European Union in breach of either the applicable requirements under the AIFMD or the private placement regime in each relevant member state.