In recent days, Russia’s invasion of Ukraine has shocked the world, has led to international condemnation and has resulted in material stock market volatility. In this short update, Dalton Investments (“Dalton” or “we”) considers the direct and indirect impact of these events on Dalton’s portfolios.

No exposure to Russia

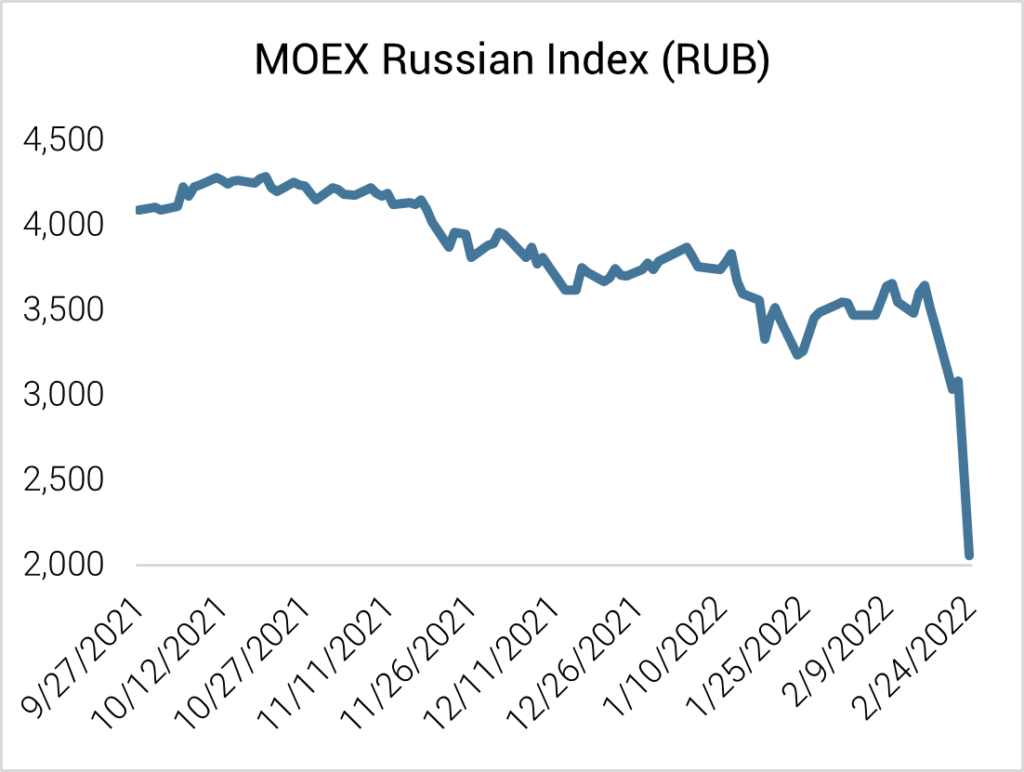

While Dalton’s broad regional mandates generally allow the flexibility to invest in Russia, we have historically found limited opportunities to invest in Russia and currently have no direct exposure. As value investors, we are naturally drawn to major market falls, looking for signs of over-reaction from short-term market participants. Indeed, before the recent escalations, we had considered again whether certain Russian energy companies might have represented an opportunity for our portfolios. With the already deeply unloved Russian market falling around 15% from its 2021 highs (measured by the MOEX and in RUB) and the promise of structurally higher oil prices (more on this later), our investment team considered whether select Russian securities really had become too cheap to ignore. After all, dominant companies paying 8-10% dividend yield sound highly attractive on paper.

In reflecting on this development, we went back to the key mantra of Dalton’s investment philosophy – seek a strong alignment of interest with the key decision makers at the company. The shady world of interconnected oligarch ownership and the ever-present hand of President Putin left us doubtful that such an alignment currently exists in the country. Bill Browder, the founder of Hermitage Capital, author of Red Notice and a previous speaker at Dalton’s annual board meetings, put it well when he states:

“If you’re investing for the long term, you have to be able to assume that when you make the money, that money is yours. You can’t just invest the money and then when it starts working, someone else takes it from you. But that’s the basic story of Russia.”

For Dalton, Russia currently remains uninvestable, with the recent events in Ukraine representing yet another reminder that, however cheap a company looks, without a clear alignment of interests, one risks disastrous investment decisions. Since our decision to again pass on investing in Russia, the Russian market fell by approximately 50% to its most recent lows in the past few days.

Key Area to Watch #1 – Taiwan

Unlike Russia, Taiwan is a country where Dalton has found many opportunities to partner with visionary and dynamic entrepreneurs running high-quality companies, not only where they have the majority of their personal assets invested in company stock, but where they have demonstrated a track record of sharing the wealth with minority shareholders – in short, perfect Dalton ideas!

Our key concern with the West’s sanction-heavy but action-light response to the Russian invasion is that it may embolden China to take similar action against Taiwan. While Putin’s recent actions have proven that it can be very challenging to predict the actions of leaders with absolute power, our base case prediction is not for an immediate copycat invasion by President Xi:

- While Ukraine is a major supplier of some commodities (indeed, it is known as “the bread basket of Europe” for its wheat production), it is tough to label it a critical part of the global economy, with nominal GDP of just $181 billion in 2021 (55th in the world). Taiwan, on the other hand, is a substantially larger economy ($786 billion, 22nd). Crucially, Taiwan is integral in the global semiconductor chain with more than 60% of global semiconductors produced in Taiwan. A recent report from “The Corner” estimated recently “if for one reason or another Taiwan could not export them, it would only take three weeks for almost all the factories that exist in Europe – automobile, meat, household appliances – to stop working, because they would have no semiconductors.”

- To Russia, Ukraine is certainly strategically important, in terms of protecting its borders from NATO members. To the rest of the world, and particularly as relates to the continued hegemonic power of the US, this is certainly not the case. Taiwan, on the other hand, is crucial to US’ global military strategy – forming part of the “first island chain”, which is a key part of the national defense strategy of the US.

- President Biden stated early and clearly that the US would not send troops to Ukraine’s aid. He has not and likely will not make such a statement on Taiwan. What we can say is that January’s incursions by Chinese aircraft into Taiwanese air space led to drills in the South China Sea by two US Navy carrier strike groups and continued the pattern of 2-3 US aircraft carriers always being within easy reach of the island. The US also continues to station tens of thousands of US troops in Japan, alongside large deployments of aircraft – many of which are on the southern island of Okinawa (a short flight from Taiwan)

For now, we are not taking action on Taiwan in our portfolios. While the risk of the invasion of Taiwan may have increased, we continue to believe this is a lower probability scenario, given Taiwan’s importance in the semiconductor supply chain and strategic importance to the US. Nevertheless, we continue to monitor China’s actions closely and remain ready to move our portfolios quickly if the circumstances change.

Key Area to Watch #2 – Oil Price

The possible disruptions to oil flows from Russia as a result of the conflict has the potential to cause the already elevated oil price to rise even further, with Russia currently the world’s third largest oil producer and second largest oil exporter. For Dalton, our key country of concern resulting from high oil prices is India, which continues to be a major importer of oil, buying over 80% of its needs from other countries. Dalton believes that India represents a structural opportunity for decades to come, given the country’s wonderful demographics and plethora of fast-growing, family-owned companies.

While high oil prices remain a negative for India, we acknowledge that today’s India is very different from the India of old. India now has the world’s fourth largest FX reserves with USD 633.6 billion (source: RBI) and is in a much more stable position than during previous periods of stress, such as 2013’s taper tantrum. We also gain comfort from the positioning of Dalton’s Indian portfolio, with a balance between domestic consumer companies and export-orientated companies (particularly business process outsourcing companies) that generate revenues in US Dollars, British Pounds and Euros.

For the broader Dalton portfolio, finding companies that benefit directly from high oil prices is challenging, given the state’s ownership of or influence on these companies. However, we continue to research owner-operator companies with dominant positions in niches, which stand to benefit from the current environment. More broadly, we remain convinced about the ability of our high-quality businesses to pass on input cost inflation to customers.

Conclusion

As long-term focused stock pickers, market volatility is our friend. Indeed, the recent market drawdowns are causing excitement in our analyst team, as stock prices (which in many cases had become somewhat frothy, particularly in the high-quality companies that meet our investment criteria) fall below our estimations of intrinsic value. We believe a continuation of this downward pressure may lead to a buying opportunity, which could deliver strong returns over the next 3-5 years. Further, as Dalton tends to target companies with very healthy (often net cash) balance sheets, the years following market collapses have historically proven to be extremely strong periods of performance for our portfolios (both in absolute and relative terms). The experienced owner-operators in which we invest tend to act in a counter-cyclical manner, taking advantage of weakness in peers to make cut-price acquisitions. Through our engagement with portfolio companies, we can also drive value creation by encouraging opportunistic buy backs of company stock.

* * * * *

This document is provided for informational purposes only, and does not constitute a solicitation of any shares in any investment vehicle managed by Dalton Investments. Such solicitations can only be made to qualified investors by means of the private placement memorandums, which describe, among other things, the risks of making an investment. Additionally, this presentation does not constitute investment advice of any kind.

All of the information in this document relating to Dalton Investments or its affiliates (collectively, “Dalton” or the “Firm”) is communicated solely by Dalton, regulated by the U.S. Securities and Exchange Commission (SEC). SEC registration does not imply SEC endorsement. No representation or warranty can be given with respect to the accuracy or completeness of the information, or with respect to the terms of any future offer of transactions conforming to the terms hereof. Certain assumptions may have been made in the analysis which resulted in any information and returns/results detailed herein. No representation is made that any results/returns indicated will be achieved or that all assumptions in achieving these returns have been considered or stated. Additional information is available on request. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on market conditions. Unless otherwise indicated, figures presented are preliminary, unaudited, subject to change and do not constitute Dalton’s standard books and records.

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE PERFORMANCE. THE VALUE OF THE INVESTMENTS AND THE INCOME FROM THEM CAN GO DOWN AS WELL AS UP AND AN INVESTOR MAY NOT GET BACK THE AMOUNT INVESTED. THESE INVESTMENTS ARE DESIGNED FOR INVESTORS WHO UNDERSTAND AND ARE WILLING TO ACCEPT THESE RISKS. PERFORMANCE MAY BE VOLATILE, AND AN INVESTOR COULD LOSE ALL OR A SUBSTANTIAL PORTION OF ITS INVESTMENT.

Any estimates, projections or predictions (including in tabular form) given in this communication are intended to be forward-looking statements. Although Dalton believes that the expectations in such forward-looking statements are reasonable, it can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this communication. Dalton expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in its expectations or any change in circumstances upon which such statement is based.

Please note that neither the Funds/Composites nor the Investment Manager/Investment Advisor complies with the requirements of the Alternative Investment Fund Managers Directive (“AIFMD”) of the European Union. No direct or indirect offering or placement of shares by or on behalf of the Funds/Composites or the Investment Manager may be made to or with investors in member states of the European Union in breach of either the applicable requirements under the AIFMD or the private placement regime in each relevant member state.