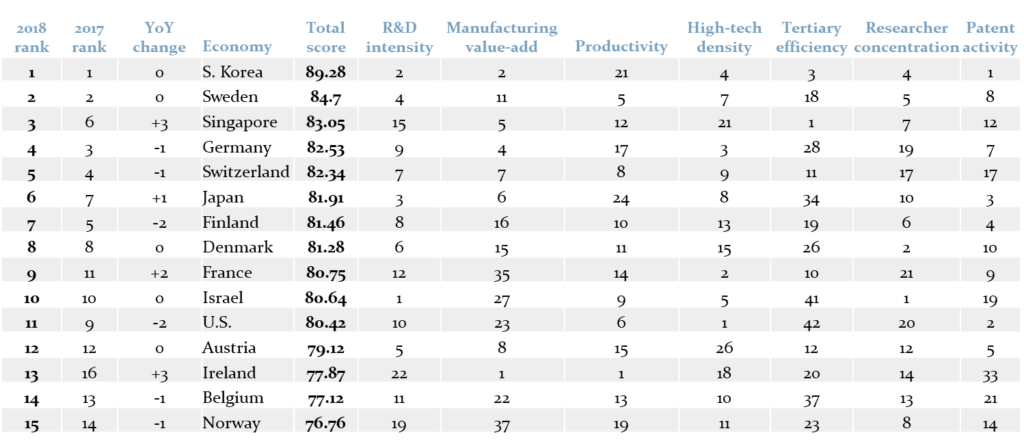

South Korea is a small but densely populated Asian country (roughly one quarter of the area of Japan, with 52 million people, of which 20 million are in the greater Seoul area alone). It has a per capita GDP of approximately $30,000, the 27th highest in the world. The country enjoys strong economic health, with one of the lowest government debt/GDP ratios globally, twin (fiscal and current account) surpluses and large foreign exchange reserves. It also has relatively low levels of inflation and unemployment. From the end of the Korean War in the 1950s, when the country was amongst the world’s poorest nations, South Korea has emerged as an economic success, with major achievements as its companies gained global dominance firstly in industrial sectors, then in electronic hardware, and now in consumer goods (cosmetics and entertainment) and technology. The country is perceived globally as an innovation leader, topping Bloomberg’s innovation index for five consecutive years.

Source: Bloomberg

Despite these achievements, we believe that the South Korean stock market may be one of the cheapest in the world (based on standard valuation metrics), with the valuation gap between it and other world markets widening in recent years.

Why does this valuation discount exist? We believe that the main reasons are historically weak corporate governance employed by Korean companies and inefficient capital allocation by their corporate management teams. In addition, there is perceived geo-political risk, given that the war with the neighboring North Korea never has ended officially.

The Dalton team currently sees opportunities in South Korea due to:

- New government attitude – Former reform activists are now important government officials. There is an increased drive to eradicate unfair corporate actions, including eliminating “tunneling” (the diversion of corporate resources from the firm to its controlling shareholders and/or affiliated companies), removing circular holding structures, strengthening minority shareholders participation through cumulative voting, and monitoring unfair or unruly activities by the major “chaebol” families.

- Stewardship Code – The Korean government has launched a Stewardship Code, which encourages asset managers and owners to interact with companies for better management of business, governance, transparency and capital allocation. Adopters of the Code need to comply with the principles or explain their activities. Importantly, the National Pension Service of Korea (NPS) (representing 7% of the entire Korean equity market) adopted the Stewardship Code on July 30, 2018. We believe that NPS’ adoption of the Stewardship Code should be a big influence, not only because of its sheer size, but also because of NPS’ new system of evaluating most of its outsourced managers on how effectively they have implemented the Stewardship Code.

- Corporate incidents – Several recent corporate incidents (including Samsung Group’s merger of Cheil Industries and Samsung C&T Corporation) have exposed the abuse of minority shareholder rights and crony-capitalism in South Korea; these incidents have increased public anger to very high levels. We believe that this anger may be a driving force for change.

- Activism – SouthKorea has increasingly seen activist activities by foreign and local firms in the last couple of years. High profile examples shareholder activism include Elliott Management Corporation’s actions against Samsung and Hyundai Motor Group.

- Private equity – Private equity activity in South Korea has increased (albeit from a low base), and Korean companies are taking note of the radical changes in capital allocation implemented by private equity firms.

- Thawing relations with North Korea – 2018 witnessed an historic summit held between US and North Korean leaders, resulting in a joint statement with the aim of de-nuclearization of the Korean Peninsula.

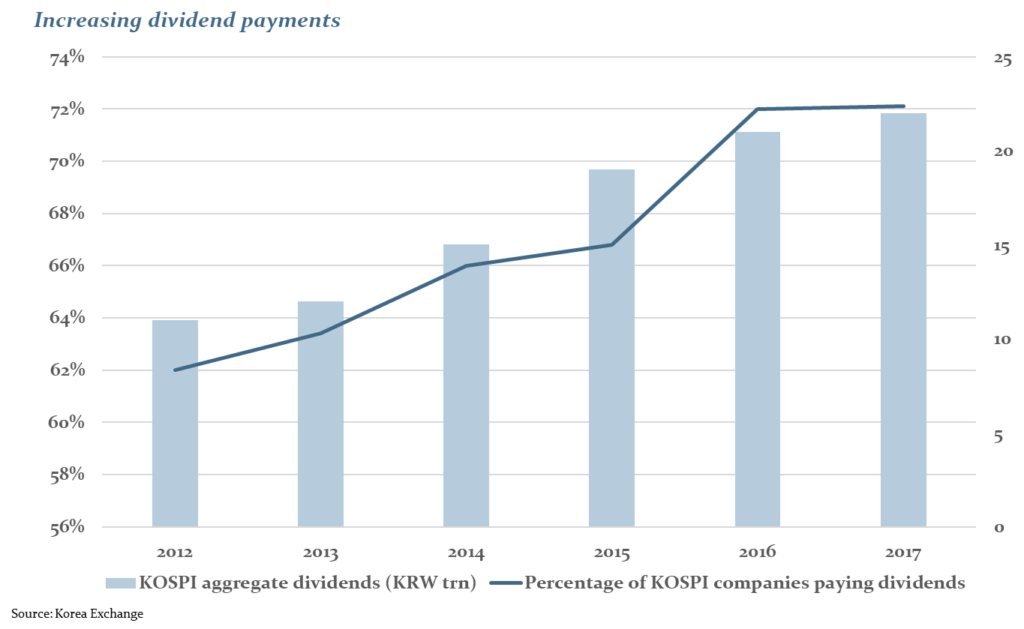

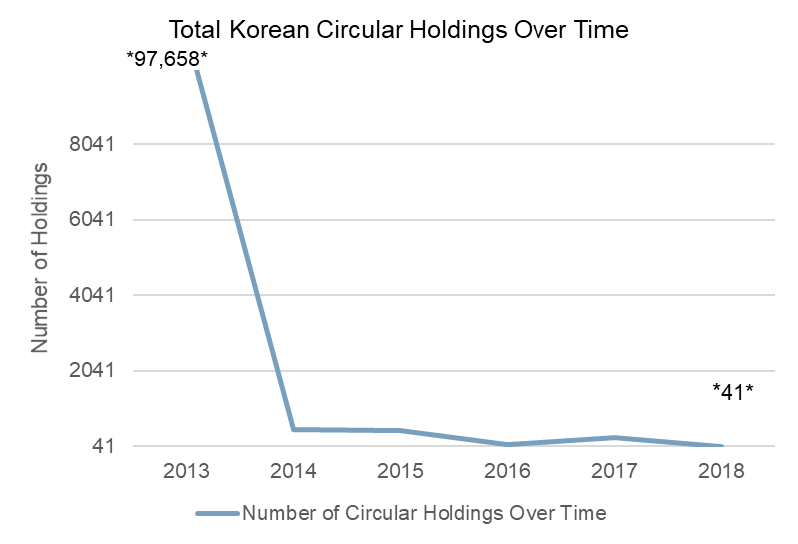

The Dalton team believes that investors have yet to acknowledge that significant changes are underway in South Korea. Firstly, we have seen several cases of South Korean companies and their management teams being prosecuted by the Korean Fair Trade Commission for attempted nefarious related-party transactions. Secondly, dividend payments have increased in the Korean market. Thirdly, there has been a major unwinding of the cross shareholdings in Korean companies. Meanwhile, the MSCI Korea Index trades below book value.

Source: Business Korea; Korea Fair Trade Commission

Dalton believes that select holdings in Korea may offer attractive long-term returns. Our key themes are:

- Good owners/managements – Companies with strong alignment of interest; managements with strong track records.

- Turnarounds – Companies with poor historic alignment of interest that are implementing changes, where we understand the rationale for the change in approach.

- Follow the money – We see opportunities to ‘piggy-back’ on other investors—in particular, private equity firms typically introduce strong alignment of interest for management teams.

- Go activist – Select companies with good businesses and assets, but poor historic track records, open to our suggestions on ways to improve capital allocation and alignment of interest. In select cases, we will use public activism to affect change, including proposals to change the companies’ statutory auditors or directors.

Improve Korea Campaign

In early 2019, a group of investors led by Dalton Investments launched a campaign aimed at addressing the sustained underperformance of the Korean stock market and improving outcomes for all shareholders. As part of this campaign, Dalton published a letter which was delivered to NPS and the Government, the National Assembly of the Republic of Korea, among others.

Korea National Pension Service

NPS is one of the largest pension schemes in the world, with over $100 billion invested in Korean equities (7% of the Korean equity market). NPS is also a signatory of the Korean Stewardship Code.

Dalton recommended the following to NPS:

- Focus on global best practices

- Actively exercise shareholder rights

- Focus on capital allocation and economic value add

- Change screening metrics for target engagement

- Focus beyond minimum dividend yield/payout

- Focus on companies’ idle cash piles

- Encourage share repurchases

- Automatically cancel treasury shares

The National Assembly of the Republic of Korea (The Government)

Korean individuals/institutions own approximately 70% of the Korean equity market, meaning the people most negatively impacted by the poor performance of the Korean stock market are the Korean. Dalton believes that, by aligning management incentives with those of all shareholders, the government can profoundly and positively impact the value of Korean companies and the wealth of countless Korean individual investors.

Dalton recommended the following to the National Assembly:

- Better alignment of tax rates

- Reduce income tax rates on dividends

- Reduce the estate and gift tax

- Reduce taxes on long-term equity investments

- Regulate stock voting systems

- Introduce a mandatory tender offer system

- Relax restrictions on capital allocation

- Adopt the use of “default options” for retirement accounts’ asset allocation choice

No representation or warranty can be given with respect to the accuracy or completeness of the information, or with respect to the terms of any future offer of transactions conforming to the terms hereof. Certain assumptions may have been made in the analysis which resulted in any information and returns/results detailed herein. No representation is made that any results/returns indicated will be achieved or that all assumptions in achieving these returns have been considered or stated. Additional information is available on request. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on market conditions. Unless otherwise indicated, figures presented are preliminary, unaudited, subject to change and do not constitute Dalton’s standard books and records.

Any estimates, projections or predictions (including in tabular form) given in this communication are intended to be forward-looking statements. Although Dalton believes that the expectations in such forward-looking statements are reasonable, it can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this communication. Dalton expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in its expectations or any change in circumstances upon which such statement is based.